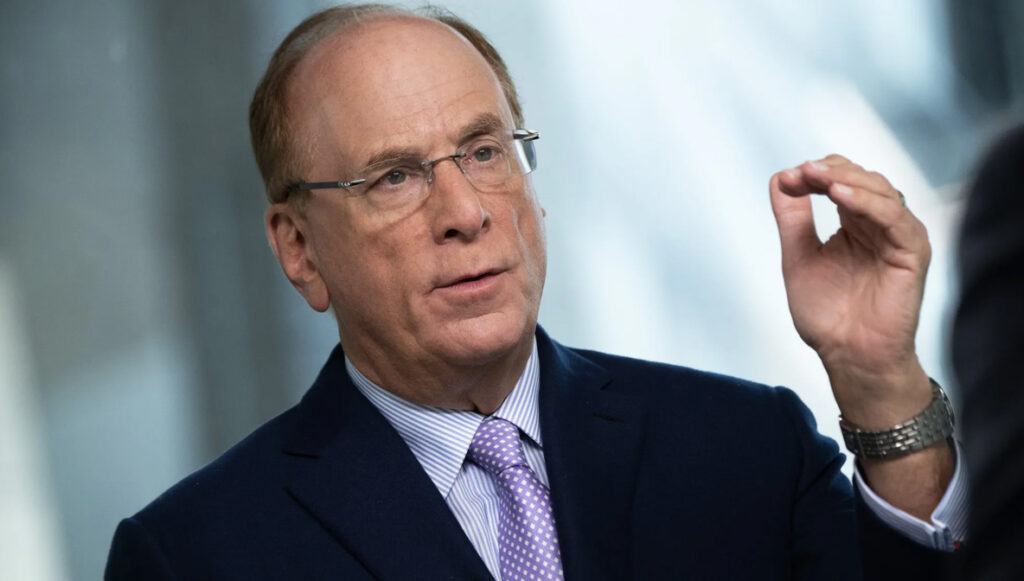

Larry Fink is an American businessman and the co-founder, chairman, and CEO of BlackRock, one of the largest asset management firms in the world. Here’s a detailed biography of his life and career:

Early Life and Education:

- Full Name: Laurence Douglas Fink

- Born: November 2, 1952, in Van Nuys, Los Angeles, California, USA

- Family Background: Fink’s father, a shoe store owner, and his mother, a homemaker, came from a middle-class Jewish family.

- Education: Fink attended UCLA (University of California, Los Angeles) and earned a Bachelor’s degree in Political Science in 1974. He then went on to receive an MBA from the UCLA Anderson School of Management in 1976.

Early Career & Rise in Finance:

- First Job: Fink started his career as a bond trader at First Boston (now part of Credit Suisse) in 1976.

- Rise in the Finance Industry: He quickly made a name for himself in the investment world. He became a managing director at First Boston, where he was instrumental in developing mortgage-backed securities—a key part of his early success.

- First Boston: After earning his MBA from UCLA, Fink started his career at First Boston, a major investment bank, in 1976. Fink quickly gained attention due to his skill in bond trading.

- Development of Mortgage-Backed Securities: During his time at First Boston, Fink was a pioneer in the development of mortgage-backed securities (MBS). This was a groundbreaking financial product that would later play a key role in the 2008 financial crisis. The idea was to bundle home loans together and sell them as securities to investors, allowing banks to offload the risk associated with mortgages.

Founding of BlackRock:

- BlackRock’s Founding: In 1988, Fink co-founded BlackRock with seven other partners. Initially, the firm focused on providing risk management and fixed-income institutional asset management services.

- Growth of BlackRock: Under Fink’s leadership, BlackRock grew rapidly, expanding its offerings to include a wide range of asset classes, including equities, real estate, and alternatives.

- Public Offering: In 1999, BlackRock went public and was listed on the New York Stock Exchange. Today, it is one of the world’s largest asset managers, with trillions of dollars in assets under management.

- Co-Founding BlackRock (1988): In 1988, Fink left First Boston to co-found BlackRock with a team of other investment professionals. The initial idea was to create an asset management firm that specialized in risk management. BlackRock started as a division of the investment bank Blackstone, and Fink was focused on fixed-income securities.

- From Fixed Income to a Global Powerhouse: In 1992, BlackRock became independent of Blackstone, and Fink took over as CEO. Fink’s leadership was instrumental in expanding BlackRock’s scope, with the firm diversifying its investment offerings beyond just fixed-income products. By the late 1990s, BlackRock began to expand into equities, alternative investments, and real estate.

Leadership and Influence:

- CEO and Chairman: Fink has served as the chairman and CEO of BlackRock since its inception, helping transform the company into a global leader in investment management.

- Role in the Financial Crisis: Fink’s leadership was crucial during the 2008 financial crisis, where BlackRock played a role in advising the U.S. government on troubled assets and helping stabilize financial markets.

- Influence on Corporate Governance: Fink is well-known for his views on corporate responsibility and has become a leading advocate for long-term, sustainable investment. His annual letters to CEOs have gained significant attention, where he often calls for companies to prioritize environmental, social, and governance (ESG) factors in their operations.

Growth and Innovation at BlackRock:

- BlackRock’s Public Offering: In 1999, BlackRock went public with an IPO, listing on the New York Stock Exchange. This allowed the firm to raise capital and continue expanding. By the mid-2000s, BlackRock was rapidly growing and expanding its reach globally.

- Acquisitions: One of the key strategies Fink employed to grow BlackRock was acquiring other firms. Notable acquisitions included the purchase of Merrill Lynch’s asset management division in 2006, which helped BlackRock expand its client base and its presence in the U.S. and international markets. This deal brought in over $1 trillion in assets under management (AUM) to BlackRock.

- Further Acquisitions: In 2009, BlackRock acquired Barclays Global Investors (BGI), another massive asset management firm, which made BlackRock the world’s largest asset manager at the time. The BGI acquisition helped BlackRock expand in exchange-traded funds (ETFs), particularly its iShares business, which remains a key component of its portfolio.

The 2008 Financial Crisis:

- Role in the Crisis: BlackRock played an important role during the 2008 financial crisis. The firm was hired by the U.S. government to help manage toxic assets that were tied to the collapse of the housing market. Fink’s firm was responsible for advising on the troubled assets of companies like AIG and Bear Stearns.

- Stability and Leadership: Fink’s leadership during the crisis was widely praised for stabilizing markets. His knowledge of risk management helped guide the company and the broader financial system through the chaos.

Transition to Sustainable Investing:

- Long-Term Value: Fink began emphasizing long-term value creation over short-term profits in his communications with other CEOs and investors. He became a major advocate for a corporate focus on sustainability, social responsibility, and good governance. His 2018 letter to CEOs stated that companies that fail to adapt to long-term environmental, social, and governance (ESG) factors risk losing their relevance.

- BlackRock’s Push for ESG: Under Fink’s leadership, BlackRock began to embrace ESG investing, offering investment products that prioritize companies with strong ESG practices. The firm became a pioneer in promoting sustainable investing and helping clients align their portfolios with long-term value creation.

Advocacy and Public Stance:

- Sustainability: Fink has increasingly emphasized the importance of sustainable investing, warning companies that they must adapt to environmental and social concerns or risk losing relevance in the marketplace.

- Annual Letters: His annual letters to shareholders and CEOs often include calls for companies to focus on long-term value creation and address issues such as climate change, diversity, and social responsibility.

- ESG Focus: Fink has pushed for more integration of ESG (Environmental, Social, and Governance) factors into investment decisions, which has shaped much of BlackRock’s strategy in recent years.

Personal Life:

- Family: Larry Fink is married to his wife, Lisa, and they have two children. Fink is known to be a private person, and he prefers to keep his personal life out of the media.

- Wealth: As of 2023, Fink’s estimated net worth is in the billions, making him one of the wealthiest individuals in the world. His wealth largely comes from his stake in BlackRock.

Awards and Recognition:

- Time 100: Fink has been named to Time magazine’s annual list of the 100 most influential people multiple times. His influence in the financial world, particularly around sustainable investment, has been widely recognized.

- Recognition for BlackRock’s Growth: Under Fink’s leadership, BlackRock has been recognized as a model for financial firms with a global reach. It has been consistently ranked as the largest asset manager in the world, with trillions of dollars in assets under management.

- Forbes: Fink is also regularly listed among the richest and most powerful people in finance by Forbes, and he has become a key figure in discussions about corporate governance, sustainability, and global finance.

Larry Fink’s Leadership Style and Philosophy:

- Emphasis on Long-Term Thinking: Fink is known for his focus on long-term strategic thinking rather than short-term profits. He has urged businesses to think beyond quarterly earnings and focus on creating lasting value for stakeholders—employees, communities, and shareholders alike.

- Stakeholder Capitalism: Fink has frequently spoken about the need for businesses to consider all stakeholders in their decisions, not just shareholders. This philosophy, often referred to as “stakeholder capitalism,” emphasizes the importance of companies being good corporate citizens and acting responsibly toward the environment, society, and the economy.

- Power of Data: As the head of the world’s largest asset management firm, Fink believes in the transformative power of data. BlackRock’s Aladdin platform, developed to manage risk and monitor portfolios, has become a key part of the firm’s infrastructure. This technological tool helps both BlackRock and its clients understand the risks in their investments and the overall financial environment.

Public Persona and Views:

- Influence on Corporate Governance: Fink’s annual letters to CEOs have become a widely anticipated event in the business world. In these letters, Fink addresses key issues ranging from corporate governance to climate change. He encourages executives to focus on long-term goals, address the concerns of shareholders and employees, and ensure the company’s actions align with global sustainability efforts.

- Climate Change and Divestment: In recent years, Fink has been vocal about the need to address climate change through sustainable investing practices. He has called for companies to disclose their carbon emissions and develop strategies to reduce their environmental impact. In 2020, BlackRock committed to eliminating investments in companies that generate more than 25% of their revenues from coal.

Controversies:

While widely regarded as a pioneer in the finance world, Fink’s approach has also drawn some criticism. Some argue that BlackRock’s size and influence allow it to wield too much power in the financial system. Additionally, while Fink advocates for sustainable practices, critics have questioned whether BlackRock’s investment strategies have always aligned with its public rhetoric on ESG.

Legacy:

Larry Fink’s legacy will likely be shaped by his pivotal role in transforming BlackRock from a small firm into a global asset management titan. His focus on risk management, long-term value, and sustainability has reshaped the finance world, and his calls for corporate responsibility have influenced both private and public sectors. Fink’s ideas around stakeholder capitalism and ESG investing are likely to have a lasting impact on the corporate world, influencing how companies approach governance, environmental responsibility, and social impact.

Is there a particular event or aspect of Fink’s career you’d like to explore further?

Conclusion:

Larry Fink’s career is a testament to the transformative power of modern finance. He turned BlackRock from a small startup into a global powerhouse and is now regarded as one of the most influential figures in the world of investment management. Through his focus on long-term growth, sustainability, and responsible investing, Fink has reshaped the finance industry and set new standards for corporate governance.

Is there a particular part of Larry Fink’s life or career that you’d like to know more about?